YOUR ONLINE ACCOUNTANT

ISO9001 Quality Certified Public Accountant & Registered Tax Agent

- Company Tax Return & Financial Report $440

- Trust Tax Return & Financial Report $440

- Partnership Tax Return & Financial Report $330

- GST Reg Sole Trader Tax Return $220

- BAS & IAS Preparation & Lodgement

ELEGANT, FLEXIBLE, LOW FEE

ONLINE TAX ACCOUNTANTS

We are Ezy Tax Online, Tax Accountant Online

Online Accounting & Taxation Services

Running a business is not easy. Let us take some of the pressure off – our team of small business accountants are experts in online business tax.

We offer low and affordable fees to Xero and Quickbooks users. our system is clear, charging a flat online business tax fee of $440 for company, $440 for trust, $330 for partnership tax return and $220 for GST registered sole trader tax return– there is no hidden additional charge for our service. Where you wish, we’ll even provide a quote before the engagement – we won’t commence our services until you have agreed with our fees.

What Clients Say

Why Clients Choose Us

Ezy Tax Online Biz = All the Small Business Tax Solutions

Wide Range of Services of Ezy Tax online Biz

Free Quote and inquiry welcome where prices or products are not shown below depending on your needs

ONLINE BUSINESS TAX RETURN & FINANCIAL STATEMENT

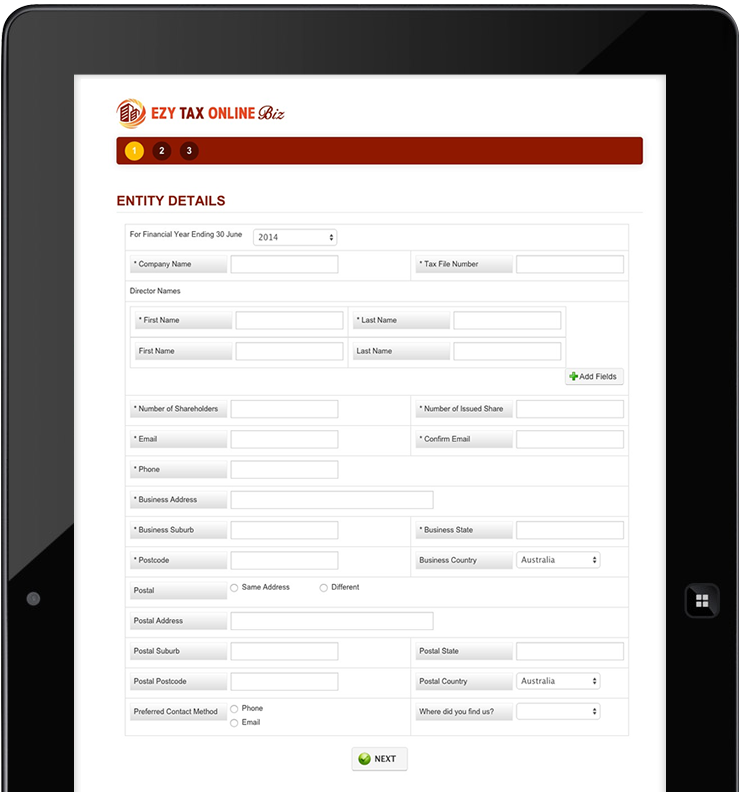

Lodge your business tax return online. This is not copy and paste business tax return like other low cost providers. You do not need to provide Profit & Loss and Balance Sheet, it is our job.

All of Australian entities must lodge tax returns every year if entities are active anytime during the financial year.

All years of business tax returns and financial statement are prepared for all of the small businesses in Australia. You can attach or email your bank reconciled accounting records or invite us to your cloud accounting software.

Some services prepare only a tax return however a proper business tax return cannot be prepared without a preparation of Profit & Loss and Balance sheet. As a public practice accounting firm as well as a registered tax agent, our service includes both of financial statement and business tax return.

This is not a DIY tax return service but prepared by qualified accountants.

Service Includes

- Business Tax Return

- Financial Statement

- Routine Adjustments for the Best Tax Outcome

- Accounting Software Adjustment

- Online Advice and Technical Help

- Appointment as Tax agent and Public Accountant

- Carried out by Registered Tax Agents and Small Business Accountants

Conditions

- Xero Use

- Online Accounting Software Use (Currently not Available on This Fee)

- Excel from Imported Bank Statement (Currently not Available on This Fee)

- Bank Reconciled Accounting Records

Company

Company Tax Return

- Financial Report

Trust

Trust Tax Return

- Financial Report

Partnership

Partnership Tax Return

- Financial Report

Sole Trader GST

Individual Tax Return

- Financial Report ($210)

Additional fee $100 applies for Desktop MYOB Users

OPTIONAL SERVICES

GST Reconciliation $70

Non-Trading Tax Return $180

Business Tax Return Amendment POA

Annual GST Return $130

Non-Lodgement Advise $30

End of Year Payroll Annual Report $140

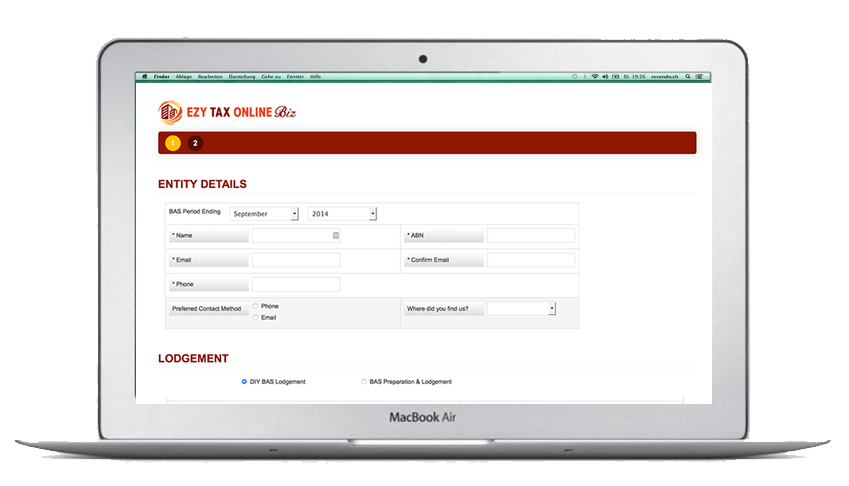

ONLINE FAST BAS LODGMENT

Four week extension also given by Tax Agent Lodgment

- DIY Lodgement

- From Accounting Software

- Preparation & Lodgement

- BAS Amendment +$20

DIY Lodgement

You Provide the Lodgement Figures

From Accounting Software

For Accounting Software Users

Preparation & Lodgement

For Non Accounting Software Users

BAS Due Date

Monthly Lodgement Tax Agent Concessions

| Period | Original Due Date | Ezy Tax Online Biz | |

|---|---|---|---|

| Other than Dec | Other than Dec | 21th of the Following Month | 21th of the Following Month |

| Dec BAS | Dec | 21 Jan | 21 Feb |

Quarterly Lodgement Tax Agent Concessions

| Period | Original Due Date | Ezy Tax Online Biz | |

|---|---|---|---|

| Sep BAS | Jul – Sep | 28 Oct | 25 Nov |

| Dec BAS | Oct – Dec | 28 Feb | 28 Feb |

| Mar BAS | Jan – Mar | 28 Apr | 25 May |

| Jun BAS | Apr – Jun | 28 Jul | 25 Aug |

XERO CLOUD ACCOUNTING SOFTWARE

Ezy Tax Online is proudly Xero Gold Partner and Xero Certified Advisor. Xero is a leading cloud-based accounting software which allows you to run your business and access your accounts from work, home or anywhere. Xero helps you to reduce your work and maintain correct accounting records. Xero uniquely provides a single platform where small businesses can collaborate easily with Ezy Tax online. You invite us to your Xero as an advisor and share the data in real-time with Ezy Tax Online. You can access our online on-demand services anytime.

CLOUD BOOKKEEPING SOLUTION

We recommend Xero, MYOB AccountRight Live and MYOB Essentials as ideal solutions for your bookkeeping.

Some benefits of this are

- Access your accounts anywhere online

- Link your business bank accounts to automatically import and match transactions, to reduce data entry

- No upfront software or server costs

- Work with an accountant

- Xero Setup & Support

- MYOB Setup & Support

- Remote Bookkeeping Assist

NEW BUSINESS SETUP

When starting a business, it must be determined how the business is to be run. Deciding a type of structure to be used to run the business is the first step. We advise the best suitable structure for your new business.

- Company ASIC Registration Package $880

- Trust Setup $280

- Partnership Setup $280

- Sole Trader ABN Registration $60

Service also includes

- Tax File Number Registration

- ABN Registration

- GST Registration

- PAYG Withholding Registration

REGISTRATION & CANCELLATION

- ABN Registration

- GST Registration

- PAYG Withholding Registration

- Other ATO Registration

- Business Name Registration

PAYROLL MANAGEMENT

- Payroll Setup & Administration

- Payslip Preparation

- PAYG Payment Summary Preparation

- PAYG Annual Report

- Employer Superannuation Fund Setup

ASIC COMPANY SECRETARIAL SERVICE

- Appointment of ASIC Agent

- ASIC Registration Change

- Share Structure Change

- Company Name Change

- ASIC Voluntary Deregistration

SMALL BUSINESS FULL PACKAGE

- Business Tax Return

- Financial Statement

- Bank Reconciliation

- Correction and Update of Accounting Records

- Tax Planning & Minimisation Strategy

- 4 x Quarterly BAS or Annual GST Return

- PAYG Annual Report

- ASIC Company Secretarial Service

- Other Requested Service

We also offer, remote bookkeeping assistance, can organize any necessary registrations or cancellations and deliver any cloud accounting solutions.

The Differences of Ezy Tax Online Biz

Low Affordable Fees

We provide superior professional services by easy processes at competitive fees. Our online discount company tax return is just $360 flat including GST.

Clear Fees & No Hidden Fees

Most of all the accountants charge the fees based on time and the total fees are unknown till you receive the invoices. Our fee system is clear and has no hidden additional charge.

Peace of Mind by Professionals

We are not only a registered tax agent but also a public practice accounting firm. You can have peace of mind with our online tax services. Our services are prepared by registered tax agent, qualified accountant, MBA and accounting degree qualified staff.

Flexible

We offer the services whichever you need. You may do some by yourself and need only tax return or may need all of requirements for relevant legislation.

Simple & Easy

You can simply fill in your business details and attach the accounting records. All are done from your home or desk.

Free Quote

We can quote our fees before the engagement where you wish. Our services are not commenced till you agree with our fees.

Overdue Tax Returns

Any year tax return is accepted. We check ATO records and clear up your outstanding tax returns.Our aim is leading your business back to right track.

Number of Businesses